Photo: economictimes.indiatimes.com

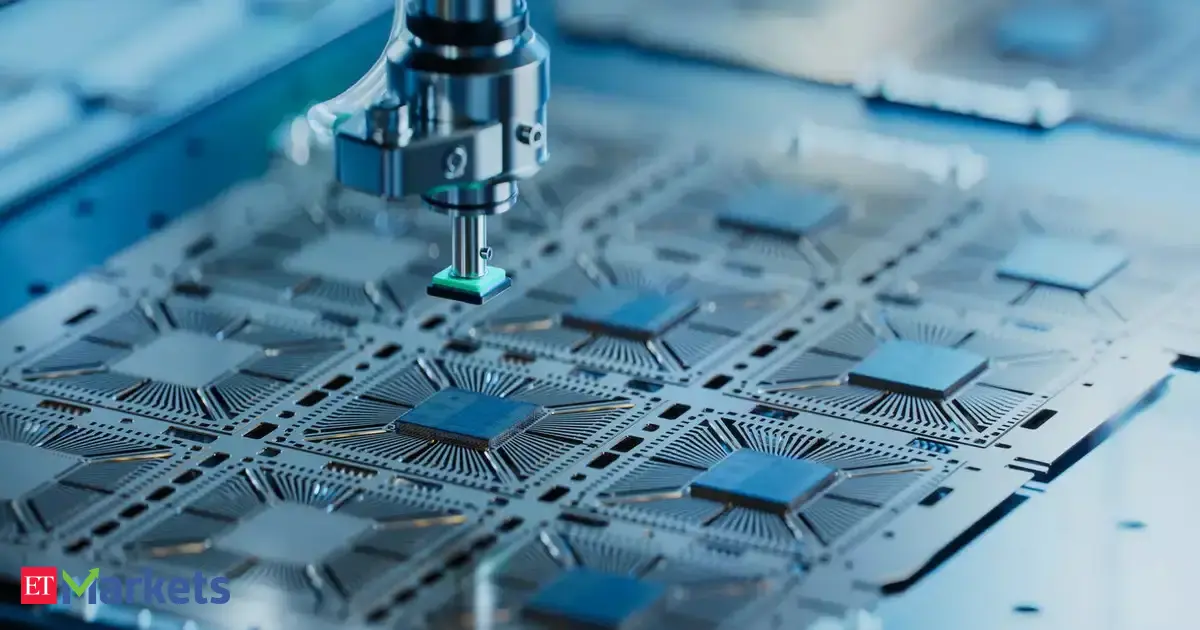

Semiconductor Stocks Plunge $500 Billion Amid AI Valuation Worries

Global semiconductor stocks, including major players like "Samsung Electronics", fell $500 billion amid fears of overvalued "Artificial intelligence" beneficiaries, raising concerns about future earnings.

- The semiconductor sector saw a dramatic selloff, with total losses reaching $500 billion as investors reacted to concerns over inflated "valuation (finance)" of AI-related companies.

- "Samsung Electronics" and Taiwan Semiconductor Manufacturing Co. were among the major Asian chipmakers that experienced significant stock declines during this tumultuous trading period.

- The decline in semiconductor stock prices highlights a growing unease about the sectors earnings potential, compounded by ongoing worries regarding rising interest rates.

Por Qué Es Relevante

This selloff reflects broader market anxieties about the sustainability of the "Artificial intelligence" boom and its impact on the "semiconductor" industry. As companies reassess their valuations, it could hinder future investments and innovation in this critical sector.